Cross-Border Family Finances: What I Learned the Hard Way

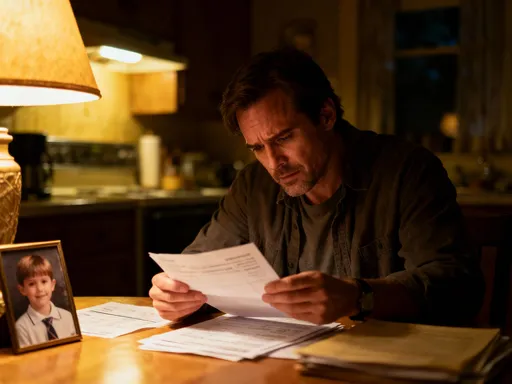

Managing money across borders seemed simple—until it wasn’t. As someone living in one country while supporting family in another, I faced hidden fees, tax surprises, and confusing regulations. I thought I was being smart, but I kept falling into avoidable traps. This is not a theory-heavy guide, but a real story of missteps, lessons, and practical fixes. If you're balancing finances across countries, you’re not alone—and what worked (and failed) for me might save you time, money, and stress.

The Reality of Cross-Border Financial Life

For millions of families around the world, financial life does not follow national borders. Earning income in one country while maintaining deep family and emotional ties in another has become increasingly common, especially with global migration patterns and remote work opportunities. This reality reshapes how money flows, how savings are managed, and how long-term goals are pursued. It is no longer just about sending money home—it’s about sustaining a dual existence, where financial decisions in one place have consequences thousands of miles away.

At first glance, cross-border finance may seem straightforward: earn in one currency, convert it, and transfer it to loved ones. But the reality is far more complex. Different banking systems, fluctuating exchange rates, and divergent tax laws create a web of challenges that are easy to underestimate. Many people begin with good intentions—setting up regular transfers, opening foreign accounts, or investing in property back home—only to discover later that small oversights have led to significant financial leaks. The emotional motivation behind these actions—love, duty, responsibility—often overshadows the need for careful planning.

Consider the typical household structure: a working adult abroad supports aging parents, siblings, or children in their home country. The income may be stable, the budget tight but manageable. Yet without a clear understanding of how money moves across jurisdictions, even well-intentioned support can become unsustainable. Over time, inconsistent transfers, poor timing of currency exchanges, and lack of legal documentation can erode savings and create dependency rather than security. The emotional weight of providing for family makes it harder to pause and reassess, even when warning signs appear.

What many fail to realize is that cross-border financial management is not a one-time setup but an ongoing process. It requires vigilance, adaptation, and coordination. It involves not just moving money, but also understanding the rules of both countries, anticipating changes in policy, and planning for both short-term needs and long-term goals. The key is to shift from reactive decision-making to proactive strategy. This means recognizing that every transfer, every account opened, and every investment made has implications that extend beyond the immediate moment.

Hidden Costs That Drain Your Budget

One of the most painful lessons I learned was that the true cost of sending money across borders is rarely what it appears to be. Banks and financial institutions often advertise low or even zero fees for international transfers, creating the illusion of affordability. However, the real expense is hidden in the exchange rate markup—a subtle but powerful mechanism that quietly reduces the value of every transaction. What looked like a $500 transfer sometimes delivered only $475 or less to the recipient, with no clear explanation. I didn’t notice the loss at first, but over time, these small discrepancies added up to hundreds, then thousands of dollars lost.

The structure of international banking plays a major role in this. When money travels from one country to another, it often passes through intermediary banks, each of which may deduct a handling fee. These charges are not always disclosed upfront, and the final amount received can vary significantly from the amount sent. In one instance, I used my local bank to send funds to my family’s account, only to learn weeks later that two intermediary banks had each taken $15 from the transfer. What I thought was a simple wire had become a layered transaction with invisible costs.

Another common drain is the maintenance of foreign bank accounts. While having a local account in the home country may seem like a smart way to receive funds, many such accounts come with monthly fees, minimum balance requirements, or currency conversion charges when withdrawing funds. Some banks impose additional costs if the account is not accessed frequently, treating it as inactive. Over time, these fees accumulate, especially if the account is used infrequently or only for occasional transfers. I once kept a savings account in my home country for emergency use, only to discover that fees had reduced the balance by nearly 10% over two years—a loss that could have been avoided with better account selection.

Then there are digital remittance platforms, which promise speed and convenience. While some offer competitive rates, others rely on complex pricing models that blend low transfer fees with poor exchange rates. Without comparing multiple options, it’s easy to default to the most familiar service, even if it’s not the most cost-effective. The solution lies in routine cost auditing: tracking not just how much is sent, but how much is actually received. By calculating the effective exchange rate and total fees for each transfer, it becomes possible to identify which services deliver real value and which quietly erode purchasing power.

Navigating Tax Systems Without Falling Into Traps

Tax obligations do not stop at national borders, and misunderstanding them can lead to serious financial consequences. One of the most unsettling moments in my financial journey came when I received a letter from my home country’s tax authority demanding documentation for income earned abroad. I had assumed that because I lived and paid taxes in my host country, I was no longer liable elsewhere. But tax residency is not always determined by physical presence alone. Many countries tax global income for their citizens or long-term residents, regardless of where the money is earned.

This is where the concept of tax residency becomes critical. Some nations use a 183-day rule to determine residency, while others consider factors like family ties, property ownership, or intent to return. Failing to understand these rules can result in unintentional non-compliance. In my case, I had not formally severed tax ties with my home country, which meant I was still required to report foreign income. While I was not double-taxed due to a tax treaty between the two countries, I was required to file additional forms and provide proof of taxes paid abroad—a process that was time-consuming and stressful.

Double taxation is a real risk for cross-border earners, but it is not inevitable. Many countries have bilateral tax treaties designed to prevent the same income from being taxed twice. However, these treaties require proactive action. You must often claim relief by submitting documentation, such as tax residency certificates or foreign tax payment records. Without this, the home country may assume no taxes were paid and demand full payment. The lesson here is clear: do not wait for a notice to act. Seek clarity on your tax status early and maintain organized records of all income and tax payments.

Another overlooked issue is reporting thresholds for foreign assets. Some countries require citizens to disclose foreign bank accounts, investments, or property if they exceed a certain value. These reporting requirements are not about taxation per se, but about transparency. Failing to report can result in penalties, even if no taxes are owed. I learned that keeping a detailed financial log—including account balances, transaction histories, and asset valuations—was not just good practice but a necessary safeguard against compliance risks.

Building a Financial Safety Net Across Borders

Life is unpredictable, and emergencies do not respect geography. A sudden illness in the family, a natural disaster, or a job loss abroad can disrupt financial stability across multiple countries. Yet, many cross-border households operate without a unified emergency plan. Savings are often scattered across different accounts, insurance coverage is mismatched to actual needs, and access to funds can be slow when time is critical. This lack of coordination increases vulnerability at the very moment when resilience is needed most.

A strong safety net begins with accessible liquidity. It’s not enough to have savings; those savings must be reachable when needed. I once had a portion of my emergency fund locked in a long-term deposit in my home country, only to realize it could not be withdrawn without penalties during a medical crisis. The money existed, but it was not usable. This taught me the importance of prioritizing accessibility over slightly higher interest rates. Keeping a portion of emergency funds in a multi-currency account with international withdrawal options ensures that money can move quickly when required.

Insurance is another critical component. Health coverage, in particular, varies widely between countries. Some expatriates assume their home country’s public health system will cover them, only to find that treatment abroad is not fully reimbursed. Others rely on employer-provided insurance that may not extend to family members back home. The solution is to assess coverage on both sides and fill gaps proactively. Private international health insurance, while costly, can provide peace of mind. Additionally, life insurance policies should be reviewed to ensure beneficiaries can claim benefits across borders without legal complications.

Equally important is the coordination of financial access. In times of crisis, family members may need to act on your behalf. This requires legal documentation such as power of attorney or joint account authorization. Without these, even simple transactions can be delayed by bureaucracy. I now maintain a secure, updated record of all essential documents and ensure trusted family members know where to find them. These steps do not prevent emergencies, but they reduce the financial and emotional strain when they occur.

Smart Tools and Platforms That Actually Help

Not all financial technology delivers on its promises. The market is flooded with apps and platforms claiming to simplify cross-border money management, but many fall short in reliability, transparency, or functionality. After testing several, I found that only a few truly made a difference. The most effective tools shared common traits: clear fee structures, strong security, multi-currency support, and seamless integration with existing banking systems.

One of the most valuable tools I adopted was a multi-currency account offered by a licensed financial institution. Unlike traditional bank accounts, this platform allowed me to hold and convert funds in multiple currencies without excessive fees. I could receive salary in one currency, pay bills in another, and send money home at competitive exchange rates—all within a single interface. The ability to lock in exchange rates during favorable market conditions gave me greater control over transfer timing and cost.

Budgeting apps with cross-border features also proved useful. While basic budgeting tools track spending, the most effective ones allow users to categorize expenses by country, monitor exchange rate trends, and set transfer reminders. Some even sync with multiple bank accounts, providing a consolidated view of global finances. This level of visibility helped me identify patterns, such as seasonal spikes in remittances or recurring fees that could be negotiated or eliminated.

For regular transfers, I shifted from traditional banks to regulated digital remittance platforms with transparent pricing. These services often offer better exchange rates and lower fees, especially for frequent transfers. The key was to compare not just the headline fee, but the total cost including the exchange rate. Platforms that publish their margin or offer rate alerts enabled me to transfer funds strategically, avoiding periods of unfavorable conversion.

The real benefit of these tools was not just cost savings, but reduced mental load. Managing money across borders can be emotionally taxing, and any system that simplifies decision-making contributes to long-term financial well-being. The best tools did not add complexity; they reduced it, allowing me to focus on goals rather than logistics.

Long-Term Planning: Saving, Investing, and Protecting Wealth

Building wealth across borders requires more than just saving money—it demands strategic coordination. Long-term goals such as retirement, children’s education, or property investment must be planned with legal and financial realities in mind. What works in one country may not be recognized or protected in another. Without alignment, families risk losing benefits, facing legal challenges, or paying unnecessary taxes when transferring or inheriting assets.

Retirement planning is particularly complex. Many countries have pension systems that are not portable or compatible with foreign schemes. If you contribute to a retirement fund in your host country, it may not be accessible or tax-efficient when you return home. Conversely, contributing to a home country pension from abroad may not count toward eligibility. The solution is to research options early and consider internationally recognized investment vehicles, such as offshore savings plans or global mutual funds, that offer flexibility and portability.

Education savings for children is another area that benefits from forward thinking. Setting aside funds in a stable currency, such as the US dollar or euro, can protect against inflation in the home country. However, accessing those funds later may require navigating foreign exchange controls or tax rules. Establishing a dedicated education account with clear beneficiaries and withdrawal terms helps ensure the money is used as intended.

Estate planning is often overlooked but essential. Inheritance laws vary significantly, and without proper documentation, assets may not pass to intended heirs. Wills must be recognized in both countries, and in some cases, dual wills may be necessary. Trusts and other legal structures can provide additional protection, but they require professional advice to set up correctly. The goal is not to avoid taxes entirely, but to ensure that wealth is preserved and transferred with minimal friction.

Making It Work: Habits That Keep You on Track

Success in cross-border finance is not about making perfect decisions, but about building consistent habits. No single action guarantees financial stability, but small, repeatable practices create a foundation of awareness and control. Over time, these habits reduce stress, prevent costly mistakes, and make international money management feel less like a burden and more like a structured part of daily life.

One of the most effective habits I adopted was monthly currency monitoring. Instead of transferring money impulsively, I began tracking exchange rate trends and scheduling transfers during favorable windows. This simple practice saved me hundreds of dollars annually. I also set up automatic alerts for rate movements, allowing me to act quickly without constant monitoring.

Regular tax check-ins became another cornerstone. Every six months, I reviewed my tax residency status, updated documentation, and confirmed reporting requirements. This prevented last-minute scrambles and ensured compliance. I also scheduled annual financial meetings with family members to discuss needs, adjust transfer amounts, and review long-term goals. These conversations fostered transparency and reduced misunderstandings.

Budget reviews, account audits, and emergency fund assessments became part of my routine. By treating cross-border finance as an ongoing process rather than a series of isolated actions, I gained confidence and clarity. The goal was not to achieve perfection, but to make steady progress—informed, intentional, and forward-moving.

Conclusion

Cross-border financial planning isn’t about mastering complexity—it’s about simplifying what matters. The journey taught me that avoiding pitfalls starts with awareness, not expertise. With the right habits, tools, and mindset, managing money across countries can become less of a burden and more of a strategic advantage. The goal isn’t perfection, but progress—steady, informed, and forward-moving.