How I Built a Smarter Education Fund — Tools That Actually Work

What if you could grow your child’s education fund without gambling on risky investments? I’ve been there — overwhelmed, unsure where to start, and tired of generic advice. After testing real strategies with real money, I discovered practical tools that balance growth and safety. This isn’t about get-rich-quick schemes; it’s about consistent, thoughtful planning. Let me walk you through what actually works when securing your child’s future. These are not theoretical ideas pulled from financial textbooks, but tested approaches that have helped real families build stability, reduce stress, and make meaningful progress toward one of the most important goals they’ll ever pursue. The journey begins not with a large sum of money, but with a clear mindset and the right tools.

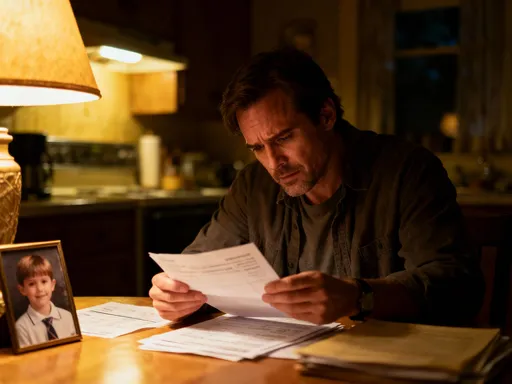

The Real Challenge Behind Education Savings

Planning for a child’s education is one of the most significant financial responsibilities a parent will face. Yet, many families begin too late or rely on outdated assumptions about college costs. Tuition fees have risen steadily over the past few decades, outpacing general inflation by a considerable margin. According to data from the College Board, the average cost of tuition and fees at public four-year institutions has more than doubled in the past 30 years when adjusted for inflation. Private colleges have seen similar increases, making higher education an increasingly expensive endeavor. For a child born today, the total cost of a four-year degree could easily exceed $250,000 by the time they enroll, depending on the institution and location.

These rising costs create a serious challenge for parents who want to provide opportunities without burdening their children with debt. The emotional weight of this responsibility can be overwhelming, especially when combined with other financial priorities like retirement savings, housing, and daily living expenses. Many parents begin saving with good intentions but quickly find their efforts derailed by unexpected life events — medical emergencies, job changes, or economic downturns. Without a structured plan, it’s easy to dip into education funds or pause contributions, which undermines long-term progress.

Another common issue is the tendency to underestimate the power of compound growth — or the damage caused by inaction. Money saved in a standard savings account earning less than 1% annually loses value over time due to inflation. Even if the balance appears stable, its purchasing power diminishes, meaning that $10,000 saved today may not cover the same portion of tuition in 15 years. This reality highlights why passive saving — simply setting money aside without a growth strategy — is insufficient. The goal is not just to accumulate funds, but to preserve and increase their real value over time.

Starting early is one of the most effective ways to address these challenges. A parent who begins saving when a child is born has nearly two decades for investments to grow. Even modest monthly contributions can yield substantial results when compounded over time. For example, investing $200 per month with a conservative average annual return of 5% would grow to over $80,000 in 18 years. Delaying that start by just five years reduces the final amount by nearly $25,000, illustrating the high cost of waiting. The real challenge, then, is not merely finding extra money, but adopting a proactive mindset and using tools designed for long-term educational goals.

Why Strategy Beats Random Saving

Saving money without a plan is like driving without a destination — you may move forward, but you’re unlikely to arrive where you want to go. Many parents fall into the trap of reactive saving, where contributions are made only when extra cash is available. While well-intentioned, this approach lacks consistency and often fails to keep pace with rising education costs. A smarter alternative is proactive planning — a deliberate strategy that aligns savings with specific goals, timelines, and risk tolerance. This shift from randomness to structure transforms financial effort into measurable progress.

A key element of strategic saving is goal-based allocation. Instead of treating education funds as a general pool of money, parents should define clear objectives: the type of institution they envision, estimated costs, and the timeline for withdrawals. This clarity allows for better decision-making when selecting investment vehicles and setting contribution levels. For instance, a family aiming to cover full tuition at a private university will need a different savings trajectory than one focused on community college followed by transfer. By attaching numbers and timelines to the goal, families can create a roadmap that guides their choices.

Time horizon is another critical factor in strategic planning. The number of years until the child enrolls in college determines how much risk can be taken with investments. Early in the timeline, when there is more time to recover from market fluctuations, a greater portion of the fund can be allocated to growth-oriented assets like stocks or stock-based mutual funds. As the enrollment date approaches, the strategy should gradually shift toward preservation, moving assets into more stable investments like bonds or money market funds. This dynamic approach, known as a glide path, is used in many education savings plans and helps balance growth potential with capital protection.

Regular reviews are equally important. Life circumstances change — income fluctuates, family size evolves, and educational goals may shift. A static plan can quickly become outdated. By reviewing the savings strategy at least once a year, families can adjust contributions, rebalance investments, and reassess goals as needed. This habit of continuous evaluation ensures the plan remains relevant and effective. Strategy, in this sense, is not a one-time decision but an ongoing process of alignment and adaptation. It replaces guesswork with intention, turning financial anxiety into confidence.

Core Tools That Power Long-Term Growth

Not all savings tools are equally suited for education funding. While traditional bank accounts offer safety, their low returns make them inadequate for long-term growth. To truly build wealth for education, parents need access to specialized financial instruments designed to maximize tax efficiency, flexibility, and compound growth. Among the most effective options are 529 college savings plans, custodial accounts, and education-focused mutual funds — each with distinct advantages and ideal use cases.

The 529 plan stands out as one of the most powerful tools available. Sponsored by states and managed by financial institutions, these plans offer tax-free growth and withdrawals when funds are used for qualified education expenses, including tuition, room and board, and certain technology costs. Contributions are made with after-tax dollars, but all investment gains accumulate tax-deferred and are never taxed if used for eligible purposes. Some states even provide additional tax deductions or credits for contributions, enhancing the savings benefit. The flexibility of 529 plans extends beyond the original beneficiary — if one child does not use all the funds, they can be transferred to another family member without penalty.

Custodial accounts, established under the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA), offer another pathway. These accounts allow adults to invest on behalf of a child, with the assets legally belonging to the minor. While they lack the tax advantages of 529 plans, they provide greater flexibility in how the money can be spent — not limited to education costs. However, this flexibility comes with trade-offs. Once the child reaches the age of majority (usually 18 or 21, depending on the state), they gain full control of the account, which may not align with a parent’s long-term vision. Additionally, assets in custodial accounts can impact financial aid eligibility more significantly than 529 plans.

Education-specific mutual funds are another option, particularly for families who prefer direct investment control. These funds are designed with long-term growth in mind, often using a mix of equities, bonds, and international securities to balance risk and return. Some target specific age groups, automatically adjusting their asset allocation as the child gets older — a feature similar to 529 plan glide paths. While they don’t offer the same tax benefits as 529 plans, they can be held within taxable brokerage accounts and provide transparency and customization. For parents who want to avoid state-specific restrictions or seek broader investment choices, this route may be appealing.

The key to success lies in matching the tool to the family’s unique situation. A 529 plan may be ideal for those committed to funding education with maximum tax efficiency. A custodial account might suit families who want to build generational wealth beyond just college. Mutual funds offer control and diversification for investors comfortable managing their own portfolios. The best approach often involves a combination of tools, tailored to risk tolerance, timeline, and financial goals.

Balancing Risk Without Sacrificing Returns

One of the biggest fears parents face when investing for education is the possibility of losing money. This concern is understandable, especially as the child’s college years approach and the need for accessible funds increases. However, avoiding risk entirely — such as keeping all savings in cash or low-yield accounts — carries its own dangers, primarily the erosion of purchasing power due to inflation. The goal, therefore, is not to eliminate risk, but to manage it wisely while still allowing room for growth.

Diversification is the foundation of sound risk management. By spreading investments across different asset classes — such as stocks, bonds, real estate investment trusts, and international markets — families reduce their exposure to any single source of volatility. For example, if the stock market declines, bond holdings may hold their value or even increase, helping to stabilize the overall portfolio. This principle applies regardless of the investment vehicle, whether it’s a 529 plan, mutual fund, or brokerage account. A well-diversified portfolio does not guarantee profits or eliminate risk, but it improves the odds of consistent, long-term performance.

Asset allocation — the percentage of funds assigned to each asset class — plays a crucial role in balancing risk and return. Younger children allow for a more aggressive allocation, with a higher percentage in equities, which historically have delivered stronger returns over time. As the child grows, the allocation should gradually shift toward more conservative investments. This process, known as rebalancing, ensures the portfolio remains aligned with the changing time horizon. For instance, a 529 plan might start with 80% in stocks and 20% in bonds when the child is five, then transition to 50/50 by age 15, and finally to 20% stocks and 80% bonds by age 18.

Periodic rebalancing is essential to maintain this discipline. Market movements can cause the original allocation to drift — for example, a strong stock market year might increase the equity portion from 70% to 85%, exposing the fund to more risk than intended. Rebalancing involves selling overperforming assets and buying underrepresented ones to restore the target mix. While this may feel counterintuitive — selling high and buying low — it enforces a disciplined, long-term approach that avoids emotional decision-making. Studies have shown that portfolios with regular rebalancing tend to have smoother growth trajectories and recover more quickly from downturns.

It’s also important to recognize that avoiding major losses is often more impactful than chasing high returns. A portfolio that earns 6% annually with moderate volatility will outperform one that swings between 15% gains and 10% losses, due to the mathematical effect of compounding after losses. This is why conservative, well-structured portfolios often deliver better long-term results for education savings than aggressive, speculative ones. The focus should be on steady, sustainable growth rather than short-term wins.

Smart Habits That Make a Difference

Tools and strategies are only as effective as the habits that support them. No financial plan succeeds without consistency, discipline, and intentionality. The most successful education funds are not built through sudden windfalls or market miracles, but through small, repeated actions that compound over time. These habits, though simple, create a powerful foundation for long-term success.

One of the most effective habits is setting up automatic contributions. Whether it’s $50 or $500 per month, scheduling transfers from a checking account to a 529 plan or investment fund ensures that saving becomes a routine part of household finances. Automation removes the need for constant decision-making, reducing the temptation to skip contributions during tight months. Over time, these regular deposits build momentum, taking advantage of dollar-cost averaging — the practice of investing a fixed amount regularly, which results in buying more shares when prices are low and fewer when prices are high. This method reduces the risk of investing a large sum at a market peak and promotes disciplined investing.

Another powerful habit is redirecting windfalls toward the education fund. Tax refunds, work bonuses, cash gifts, or even money saved from lifestyle changes — such as reducing dining out or refinancing a mortgage — can be channeled into the savings plan. These one-time boosts accelerate progress without impacting the regular budget. For example, contributing a $3,000 tax refund annually could add over $100,000 to the fund in 18 years, assuming a 5% average return. Treating unexpected money as an opportunity rather than disposable income transforms occasional gains into lasting value.

Lifestyle adjustments also play a role. Many families find they can free up hundreds of dollars each month by reviewing subscriptions, negotiating bills, or choosing more affordable alternatives for entertainment and shopping. While these changes may seem minor individually, their collective impact is significant. Redirecting even 20% of those savings into the education fund creates a consistent growth engine. The key is not deprivation, but conscious spending — aligning financial choices with long-term priorities. When parents involve children in this process, they also teach valuable lessons about responsibility and delayed gratification.

Finally, maintaining a long-term perspective helps sustain these habits. Progress may feel slow in the early years, especially when balances grow gradually. But staying focused on the ultimate goal — a child’s future — reinforces commitment. Celebrating milestones, such as reaching $10,000 or $25,000 in savings, can provide motivation. These habits, when practiced consistently, do more than grow money — they build financial confidence and resilience.

Avoiding the Traps That Catch Most Parents

Even well-intentioned parents can fall into financial traps that undermine their education savings efforts. These mistakes are often not due to lack of care, but to common behavioral biases, misinformation, or overlooked details. Recognizing these pitfalls is the first step toward avoiding them.

One of the most frequent errors is chasing investment trends. When a particular stock or sector performs well, there’s a natural temptation to invest heavily in it. However, trying to time the market or pick individual winners is rarely successful, especially for long-term goals like education funding. Most investors, including professionals, fail to consistently beat the market. Instead of chasing performance, a better approach is to stick with diversified, low-cost index funds or target-date portfolios that align with the child’s age. These options offer broad exposure and reduce the risk of overconcentration in volatile assets.

Another trap is ignoring fees. Investment products often come with management fees, expense ratios, and administrative costs that eat into returns over time. A fund with a 1.5% annual fee may seem small, but over 18 years, it can reduce the final balance by tens of thousands of dollars compared to a low-cost alternative with a 0.2% fee. Families should carefully review the fee structure of any investment vehicle and prioritize low-cost options whenever possible. In 529 plans, for example, some states offer direct-sold plans with lower fees than advisor-sold versions.

Overconfidence in personal financial knowledge is another risk. Some parents believe they can manage investments better on their own, avoiding professional guidance entirely. While self-education is valuable, complex decisions about asset allocation, tax implications, and risk management often benefit from expert input. A fee-only financial advisor, particularly one experienced in education planning, can provide objective recommendations without conflicts of interest. Seeking advice does not mean losing control — it means making more informed choices.

Finally, many families fail to coordinate their savings with broader financial goals. Pouring all available resources into education savings while neglecting retirement or emergency funds can create future strain. It’s important to maintain balance — saving for college should not come at the expense of long-term personal security. A holistic financial plan considers all priorities and allocates resources accordingly. Avoiding these traps requires awareness, humility, and a commitment to continuous learning.

Putting It All Together: A Sustainable Plan for the Future

Building a smarter education fund is not about finding a single perfect solution, but about integrating multiple elements into a cohesive, adaptable strategy. It begins with recognizing the real cost of education and the urgency of starting early. From there, families must move beyond random saving and adopt a structured approach that includes clear goals, appropriate tools, disciplined habits, and ongoing review. The most successful plans are not rigid, but flexible enough to adjust to life’s changes while remaining focused on the long-term objective.

A sustainable plan starts with an honest assessment of financial capacity and educational aspirations. How much can realistically be saved each month? What type of school is the target? What other financial responsibilities must be balanced? Answering these questions helps determine the right mix of 529 plans, custodial accounts, or mutual funds. It also informs the asset allocation strategy and contribution schedule. Once the framework is in place, automation and consistent habits ensure steady progress.

Risk management remains central throughout the journey. Diversification, rebalancing, and fee awareness protect the fund from avoidable losses. At the same time, avoiding emotional decisions and common behavioral traps keeps the plan on track. Regular check-ins — annually or after major life events — allow for course corrections without derailing momentum.

Ultimately, securing an education fund is not just a financial act, but a profound expression of care and commitment. It reflects a parent’s desire to open doors, reduce future burdens, and empower their child with opportunity. The process may require sacrifice and patience, but the rewards extend far beyond dollars and cents. It builds a legacy of responsibility, foresight, and love. Success is not measured by perfection, but by persistence — by showing up, making smart choices, and staying the course, year after year. That is how a smarter education fund is truly built.